If you follow the news at all, you have undoubtedly heard about rising interest rates. You also may be wondering how these rates are affecting the value of your NYC Brownstone, or if you are considering purchasing a new Brownstone, what will prices look like in the future.

To begin to understand how prices will react to the rising rates, it’s best to first discuss why rates are rising in the first place. The Federal Reserve Bank controls interest rates as a tool to control the inflation rate. They want to keep inflation low and after several years of pandemic related government stimulus and artificially low interest rates needed to help get us through one of the most trying times in history, inflation is sky high.

Simply put, the high rates are meant to quell inflation by slowing down an overheated economy and putting the brakes on consumerism.

High Interest Rates Push Down Prices

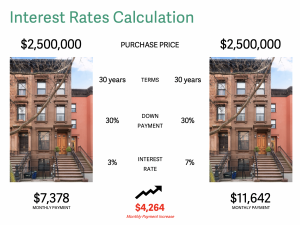

The high interest rates actually push down real estate prices since most real estate is purchased with borrowed money. The cost to borrow the money goes up, and most people do not consider the overall cost of the property to be their main concern. The main concern is the monthly mortgage payments, and the high rates mean the same mortgage payment can pay for a much less expensive property.

For example, a 2.5 million dollar Brownstone bought with a 3% mortgage will incur about a $7,000 monthly mortgage payment. When rates go up to 7%, that payment increases to about $12,000. With fewer people able to afford that extra payment, the price of the underlying real estate goes down.

High Interest Rates Also Push Up Rents

Our economy has a lot of moving parts and it is not quite that simple, however. Rising rates make home ownership much less accessible to many people. Unable to purchase their own home, they are forced to rent for another few years until they can increase their income or rates come back down.

This increase in rental demand pushes rents up, which in turn pushes up the amount of income that rental properties can command, which in turn pushes up real estate prices, the exact opposite of what the Fed is trying to accomplish by raising rates. Controlling interest rates is not the perfect tool to slow inflation, but it is the only tool available.

Rates Might Still Go Up

To further complicate things, it’s not only the current interest rate that affects prices, but the future prediction of interest rates as well. We know that as much as rates have risen recently, they might continue going up.

Homeowners and investors both want to purchase their properties with loans having the lowest interest rate possible, and since everyone knows rates will be higher next month compared to today, there is an incentive to purchase properties sooner rather than later, and the increased demand also pushes up prices.

The good news about interest rates is that if you have a current fixed rate mortgage, and rates rise, your current payment will stay the same. Conversely, if rates fall, you can always refinance to a loan with a lower interest rate.

Also, it is important to remember that rates are not high by historical standards, they were exceptionally low and are just moving to the historical average. So while interest rates are a concern, this does not mean this is a bad time to buy, whether you are shopping for a place to live in or an investment.

Schedule a call with me here if you have any interest in obtaining a complimentary valuation for your home or buyer consultation.

Connect with me on Linkedin or Instagram for more information on the townhouse and multifamily market.

Authored by: Stanley Montfort

To see Manhattan townhouse listings, click here.

To see Bedford-Stuyvesant townhouse listings, click here.

To see Crown Heights townhouse listings, click here.